Best Of The Best Info About How To Lower Your Mortgage Principal

:max_bytes(150000):strip_icc()/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-02-d54b2295a00646f5b046571b0f099aad.jpg)

Drop your private mortgage insurance after you've gained 20% equity in the home.

How to lower your mortgage principal. Simple interest = principal x interest rate x. Simple interest is based on your mortgage principal, or the total amount of money borrowed, and can be calculated with this formula: Ways to pay down your mortgage principal faster 1.

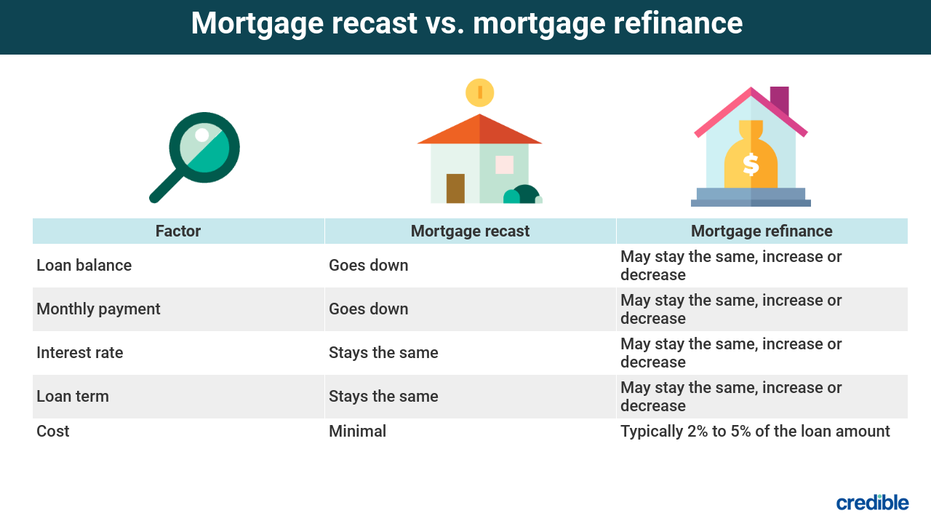

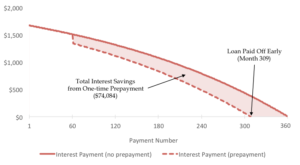

Recasting your loan involves applying a large lump sum payment to your loan principal and maintaining the same maturity (payoff) date. Making just one extra payment towards the principal of your mortgage a year can help take years off. Just make the first payment of $900, the second payment of $901, and so on.

Although refinancing is the most popular way to lower your mortgage payment, it’s not always the ideal option. One of the best ways to lower your mortgage payment is by refinancing your home loan. The new, smaller balance equates to lower monthly payments.

Make one extra payment every year. Take advantage of the government gse's mortgage relief product before it's too late. Another way to lower your mortgage payment is to refinance to a longer loan term.

Refinance to a longer loan term. To get a lower mortgage payment when just starting out, make sure your credit profile is as good as you can make it and consider your choices about the type of mortgage. Paying additional principal on your mortgage can save you thousands of dollars in interest and help you build equity faster.

As your financial situation changes, you can. Many lenders charge a servicing fee and have equity requirements to recast a mortgage. To help distressed homeowners lower their monthly mortgage payments, the u.s.

Departments of the treasury and of housing and urban development established the home. Refinancing your mortgage can lower your payments and is a good option for newer loans. By refinancing the loan to a longer term, you’ll lower your monthly payment by extending the time you’re paying off the principal.

There are several ways to prepay a mortgage: As a rule of thumb, a mortgage refinance is probably worth it if you can shave at least. You might cut the length of your mortgage by eight years if you.

By refinancing the loan to a longer term, you’ll lower your monthly payment by extending the time you’re paying off the principal. Round up your mortgage payments. Keep in mind, though, that any extra amount paid to reduce your principal balance can knock years off your mortgage term.

Ad if you owe less than $420,680, take advantage of a generous mortgage relief program & refi.