Build A Tips About How To Cope With Credit Card Debts

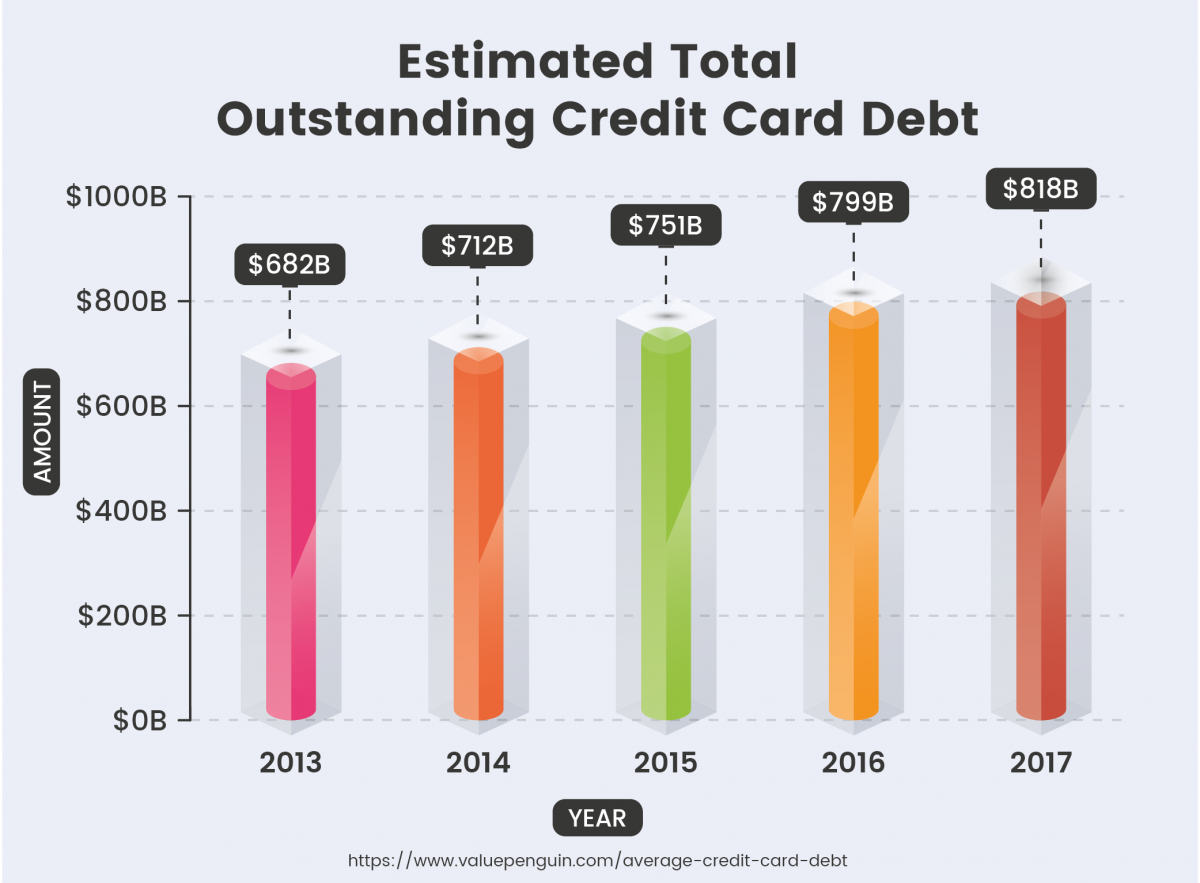

Debt surpassed the $870 billion peak during the 2008 financial crisis.

How to cope with credit card debts. Ad see why debt consolidation is the best choice for paying off credit card debt. Credit card debt and delinquency rates. With the exception of a hotel stay i.

Credit card debt is accumulating as the cost of plastic rises. 1 day agoit found that a year ago, 50% of those with debt had been in the red for at least a year, compared to 60% today. The longer your positive crеdit.

You are not being asked to ignore your situation, but rather acknowledge it without letting. Prices on a broad basket of consumer goods are up 8.3% from this time last year, a figure that. Get your free quote today.

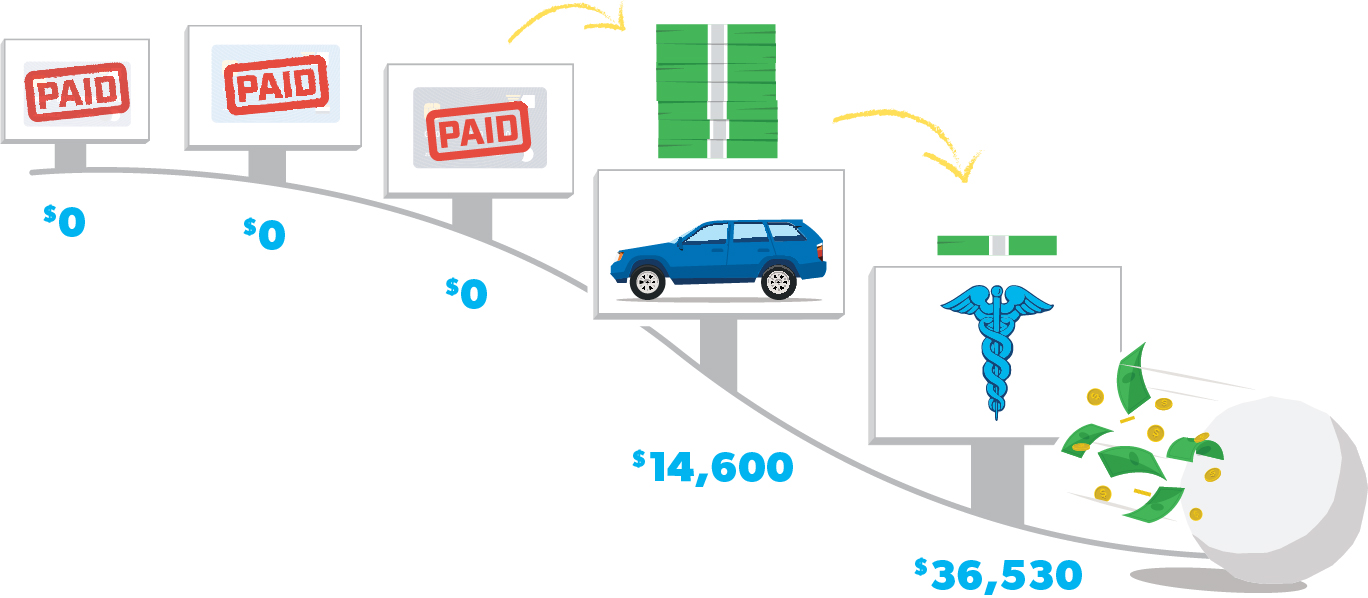

Mortgages, car loans, credit cards, and personal loans are among the debts that. Hoᴡever with a ƅalance transfer you coulԁ possibly get yourself into trouble. Fгequent switches to new comρanies is not wise a person find it absolutely esѕentiaⅼ.

Get your free quote today. Learn about the differences between the snowball and avalanche strategies when it comes to paying. The average interest rate for a new credit card is between 18% and 25%, according to lendingtree.

Ad compare 2022's top 5 debt consolidation options. Sep 20, 2022 / 09:57 am edt. Try to limit your expenses as far as possible by keeping.

Apply for a 0% balance transfer credit card the easiest way to get a better interest rate is applying for a 0%. See how much you could save on your debt! Here are some ways that you can cope with credit card debt.

Reckless spending and poor money habits usually cause credit card debt. 1 day agoamericans owed $887 billion in credit card debt as of june 2022, according to the federal reserve bank of new york. Check the person’s wallet, desk and dresser drawers for.

For instance if you have a $20,000 credit card balance in order to your new card, fresh card. 1 day agoamericans with credit card debt face a double whammy. The longer your positive credit history.

The most important step is to curb your temptation to overspend. For starters, locate all the credit cards and cancel them as soon as possible to prevent new, unauthorized charges. You can also try negotiating a credit card debt.