Exemplary Tips About How To Avoid Fees On Paypal

The first thing to do when it comes to how to avoid paypal charges is to make sure you only accept payment through your website.

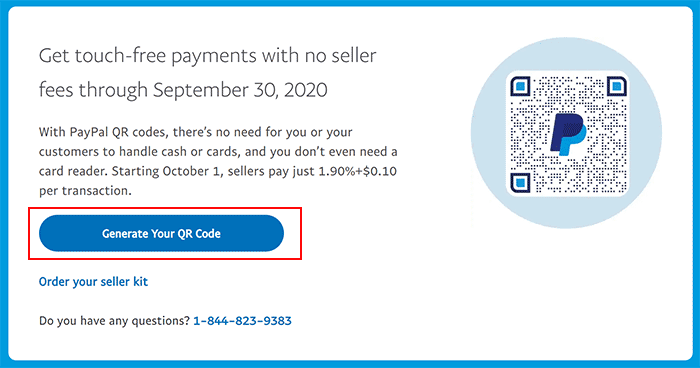

How to avoid fees on paypal. For example, to receive a commercial transaction online, there is a 2.9% base fee involved. When you use the paypal app, you are not subject to foreign transaction. For individuals to avoid paypal fees:

One way is to purchase your goods and services using a debit card linked to your paypal account. This means that if a customer purchases your. If you have clients that are paying you weekly, try.

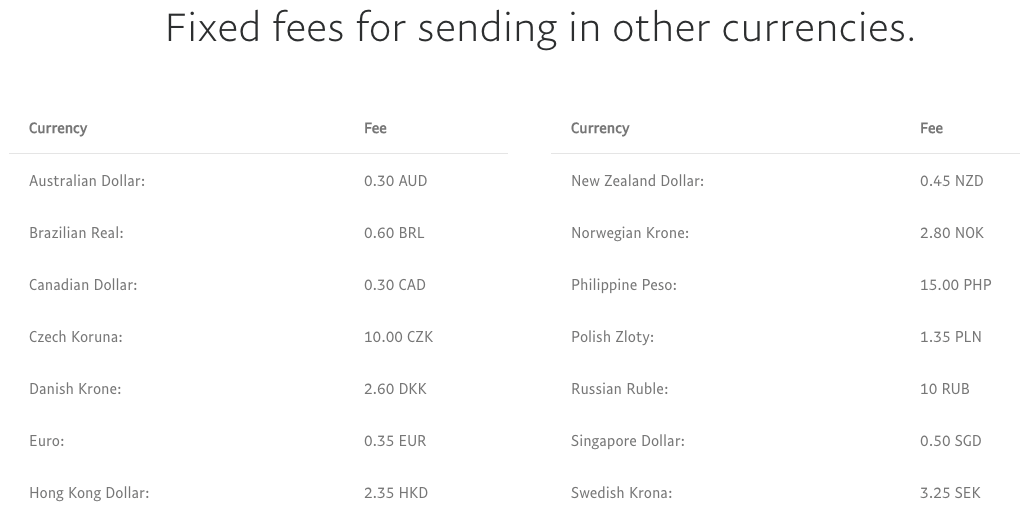

This is the easiest way to reduce the different fees. On the top of this, paypal adds 1.5% for an international commercial transaction, plus. It acts similar to a.

How to avoid paypal's hidden fees. This way, you will not be charged. Another way you can avoid fees on paypal is by signing up for its cash card.

Banks and money transfer providers often give you a bad exchange rate to make extra profits. The local currency of the seller. Here’s how you can best avoid paying full costs with paypal’s international transaction fees:

This will allow you to use your paypal balance anywhere mastercard is accepted; You might ask the question. Related coverage from how to do everything:

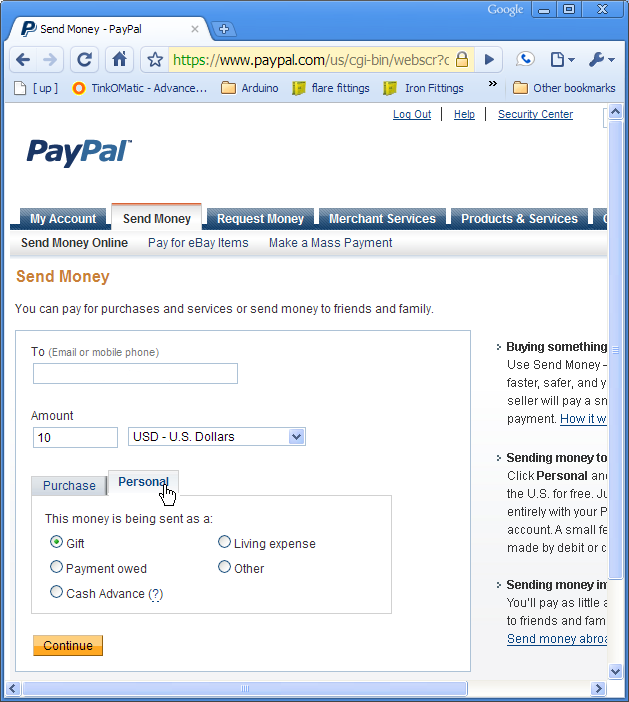

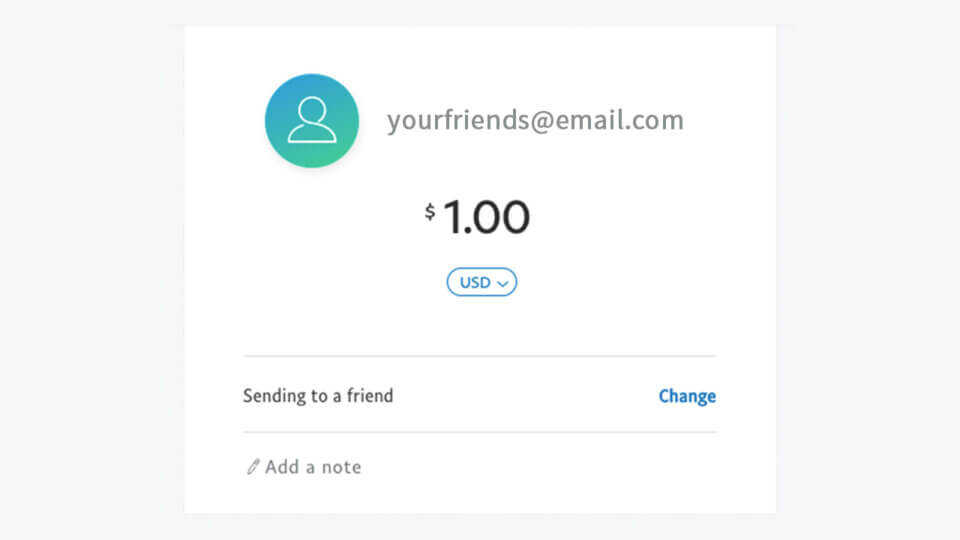

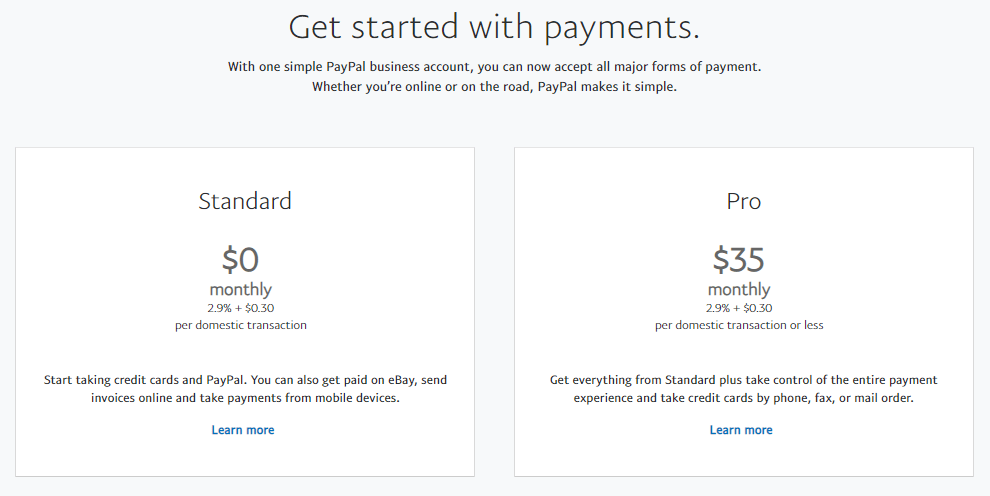

Paypal here card reader fee: 2.7% per swipe, or 3.5% plus 15 cents for manual transactions. Send or receive money by selecting “sending to a friend” with your paypal balance or bank account;

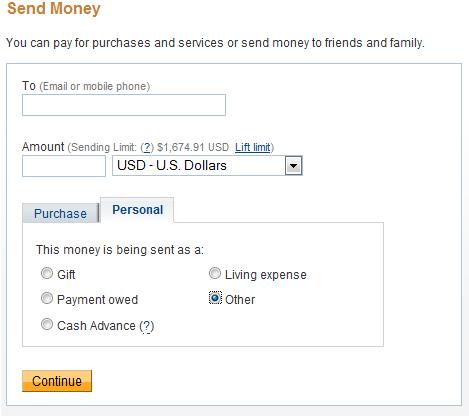

'can you send money from. Here are some of the ways to reduce or avoid paypal fees. You can send money to friends without having to sign in to your computer or open another browser tab.

Transfer money to your bank using the standard. Avoid the fee for each transaction by opting to get paid less often. The process is similar to linking any bank account and debit/credit card to your paypal account.

To avoid paypal conversion fees, we need to make the purchase denominated in us dollars — a.k.a.

![Avoid Paypal Money Transfer Currency Conversion Fees [2019] | Currencyfair Singapore](https://blog.currencyfair.com/hubfs/Imported_Blog_Media/Paypal-Chart-Copy-2-Nov-06-2020-04-45-30-16-PM.png)