Top Notch Tips About How To Settle Debt With Creditors

Get a free quote from a certified debt consultant!

How to settle debt with creditors. Ad americor® can help you get out of debt quicker. An account will be set up in. If you know the highest you can pay back is around 60% of your original debt, for instance, begin.

Here is how a typical debt settlement program works: The name and address of the original creditor; Get a free quote from a certified debt consultant!

The goal is to lower the amount you owe into something you can afford to pay so. Being able to avoid bankruptcy also benefits a debtor. If you were just to pay an.

It is easy to apply. Debt settlement works by negotiating your current debt with your creditors (lenders) and debt collectors. You can negotiate a settlement with a single creditor or collector.

Mail a certified letter (return receipt requested) asking for. Debt settlement negotiations work in two basic ways: Ad americor® can help you get out of debt quicker.

If you want to make a proposal to repay this debt, here are some considerations: Another option that will keep your credit whole and help pay off your debt faster would be to simply pay more than the minimum payment. Ad see an experienced local bankruptcy attorney now!

Ad a more equitable community. Consider creating a range of payment options from one “lowball” amount up to a middle ground. When debtors cannot repay their bills in full, they should.

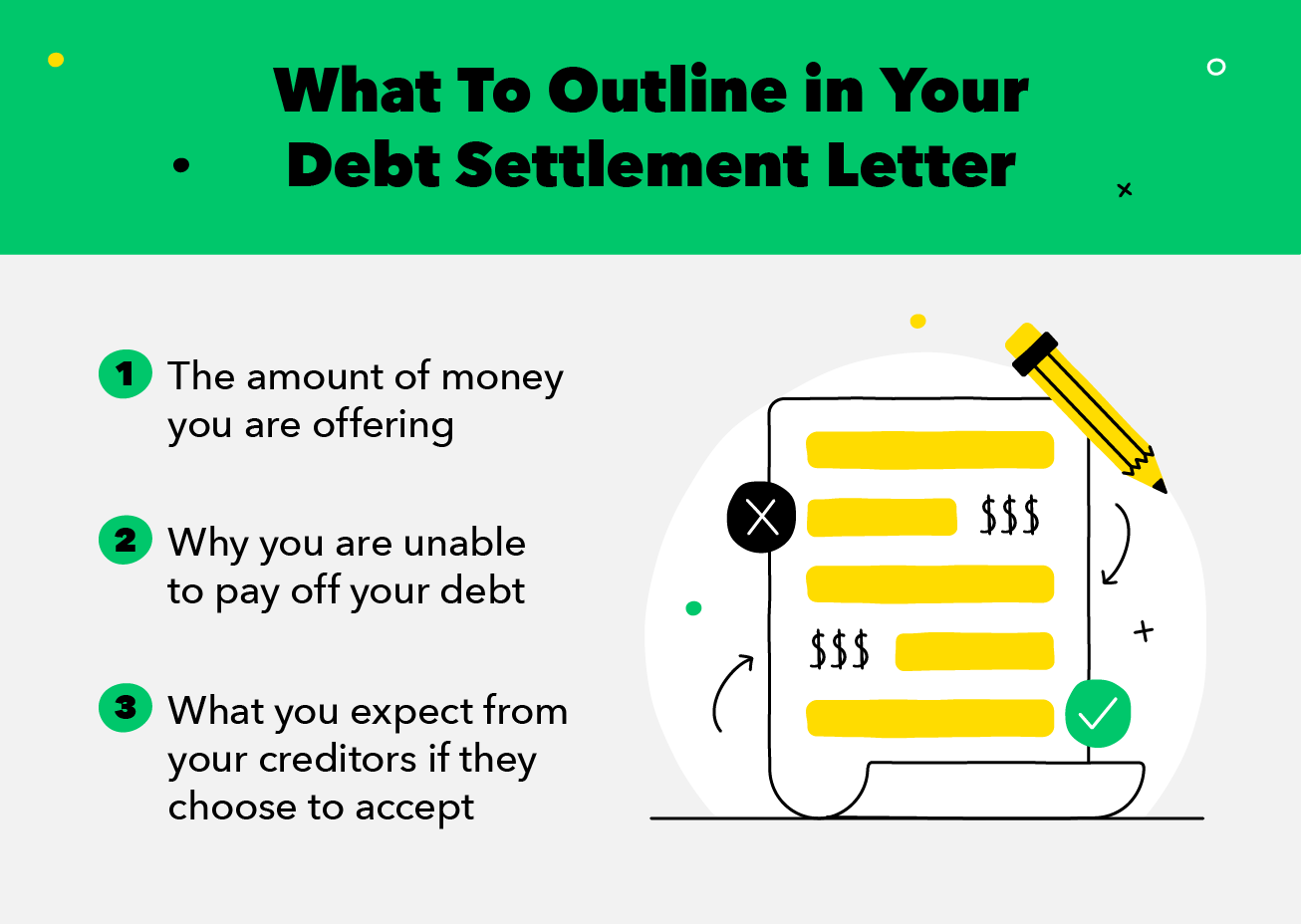

This works best for debts. Try negotiating settlements with credit card companies or other creditors on your own. First, you need to keep a record of your finances, such as income and expenses, and the exact situation that caused your inability to keep up with your payments.

Whether the collection agency has paperwork to prove you owe the debt; If so, the easiest way to start negotiations is to inform the caller that you wish to settle the debt. Your debt settlement company will ask you to stop making payments to your creditors.

Be honest with yourself about how much you can pay each month. Debt settlement programs generally work with your creditors to negotiate reductions of as much as 50% to 60% or more of the balance you owe. You can enroll in a debt settlement program to.

![How To Write A Debt Settlement Letter + [Template] - Self. Credit Builder.](https://images.ctfassets.net/90p5z8n8rnuv/XBxsRFVNEzwXybTf2fkjr/3a9e3716a8ae33d22e49229369878454/Debt_settlement_letter_asset-01.jpg)