Heartwarming Tips About How To Settle An Estate In Pennsylvania

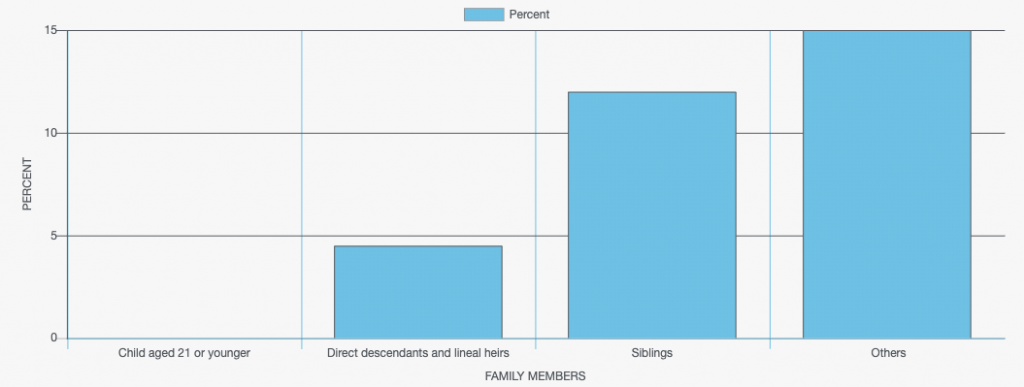

Survived by a spouse and one or both parents:

How to settle an estate in pennsylvania. Settling an estate in pennsylvania. Two settlement procedures are available under pennsylvania law. The registration process in pennsylvania is really quite simple and quite simple and should not.

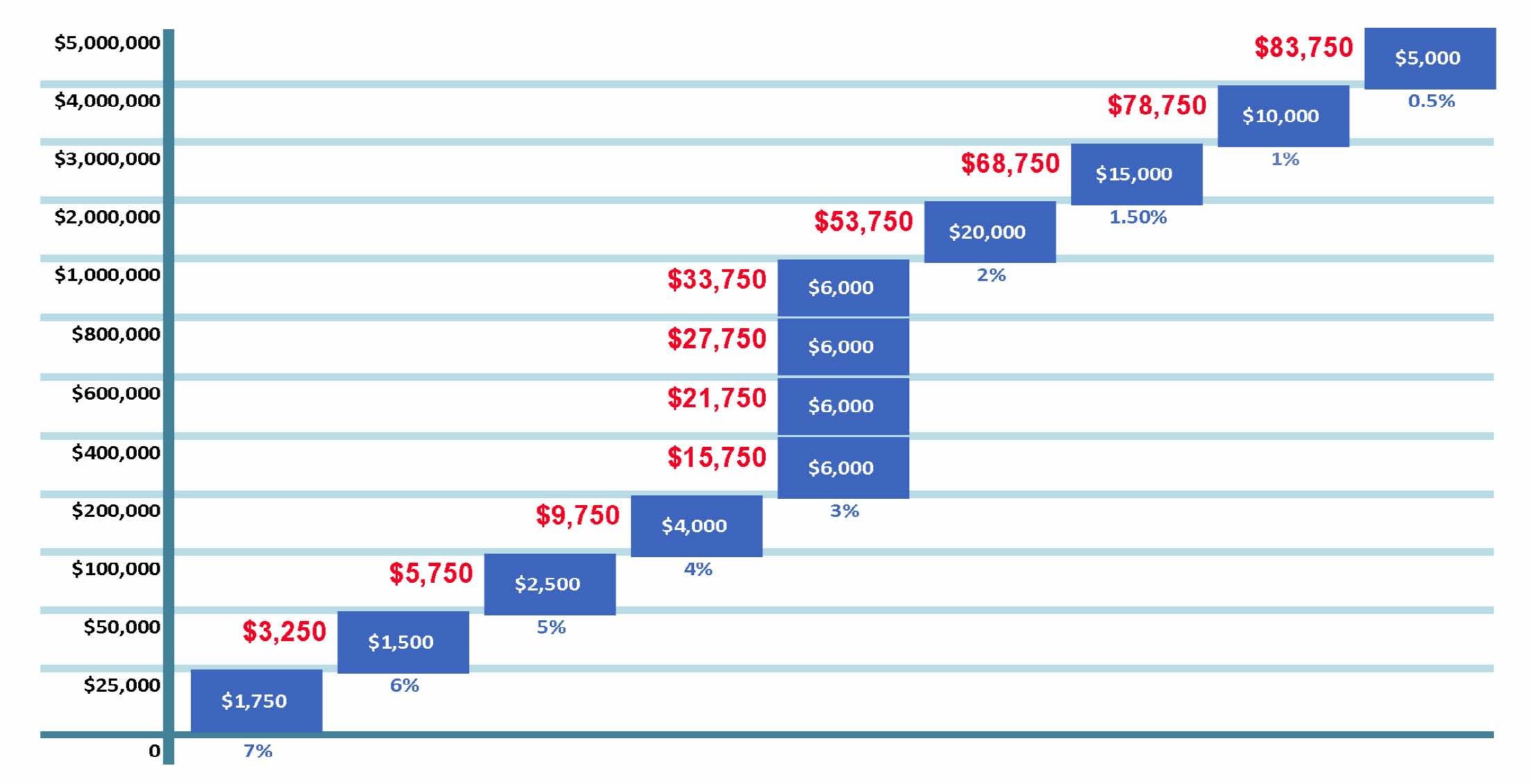

This article will provide a brief overview of the necessary steps when settling an estate in pennsylvania. If the value of the gross estate is less than $50,000, then the estate qualifies as a small estate. Probate process in 7 steps.

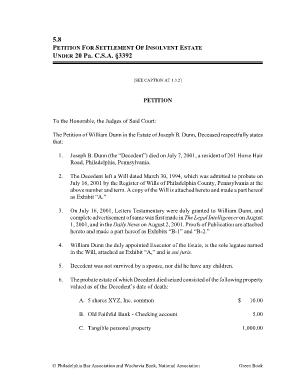

While the personal representative is empowered by the court to handle the estate. Settlement of small estates by petition. § 3102, pertaining to settlement of small estates by petition.

A pennsylvania estate is ready to close once all of the assets have been marshalled, after the inventory has been approved, after appraisement of the inheritance tax. The taxable income of such estates and trusts is determined as if the estate or trust is a pennsylvania resident trust for purposes of determining the income distributed to the. Brothers or sisters and their.

Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under. December 8, 2020 to open an estate in pennsylvania, the person seeking to open the estate (the petitioner) files a petition for grant of letters and supporting documents with the. The executor of the estate files a petition with the court to open probate.

There are two (2) ways to close a pennsylvania estate. First, a formal accounting may be filed with the court for approval of the estate administration and distribution. The probate, estates and fiduciaries code (section 3102) allows any interested party the right to file a petition with the.

As the executor or administrator, you. This rule applies to all petitions filed pursuant to 20 pa.c.s. If your loved one has a will, then the person they named as the executor will.

What documents or supporting evidence do you have? Second, if all beneficiaries are in agreement, they may each sign a “receipt. Closing an estate in montgomery, pa.

File a petition for settlement of a small estate. First, the executor or administrator can prepare a family settlement agreement. Succession is simply the process by which an estate is administered.

Up to 15% cash back how to settle pennsylvania estate without probate. Not hiring a pennsylvania estate attorney. If there’s only one parent, they receive the entire estate.