What Everybody Ought To Know About How To Reduce Or Eliminate Debt

It’s important to work debt repayments into your monthly.

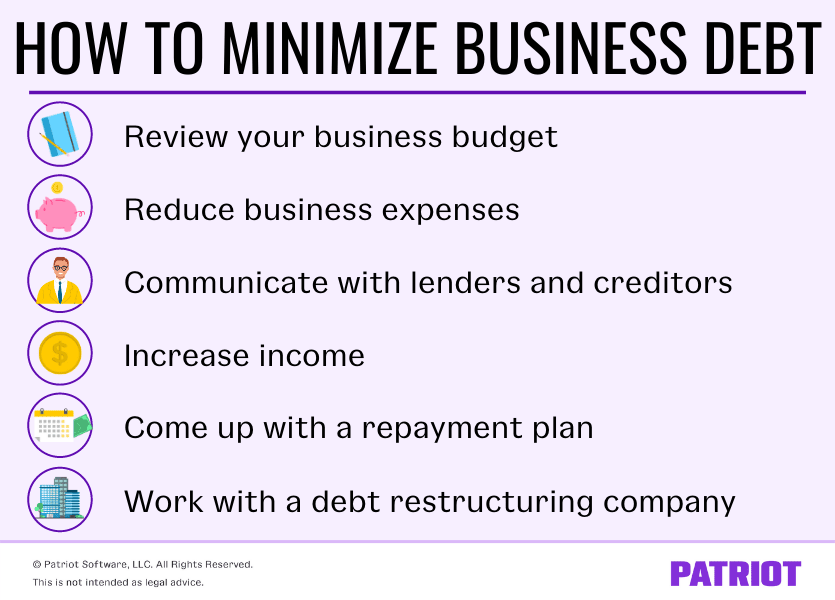

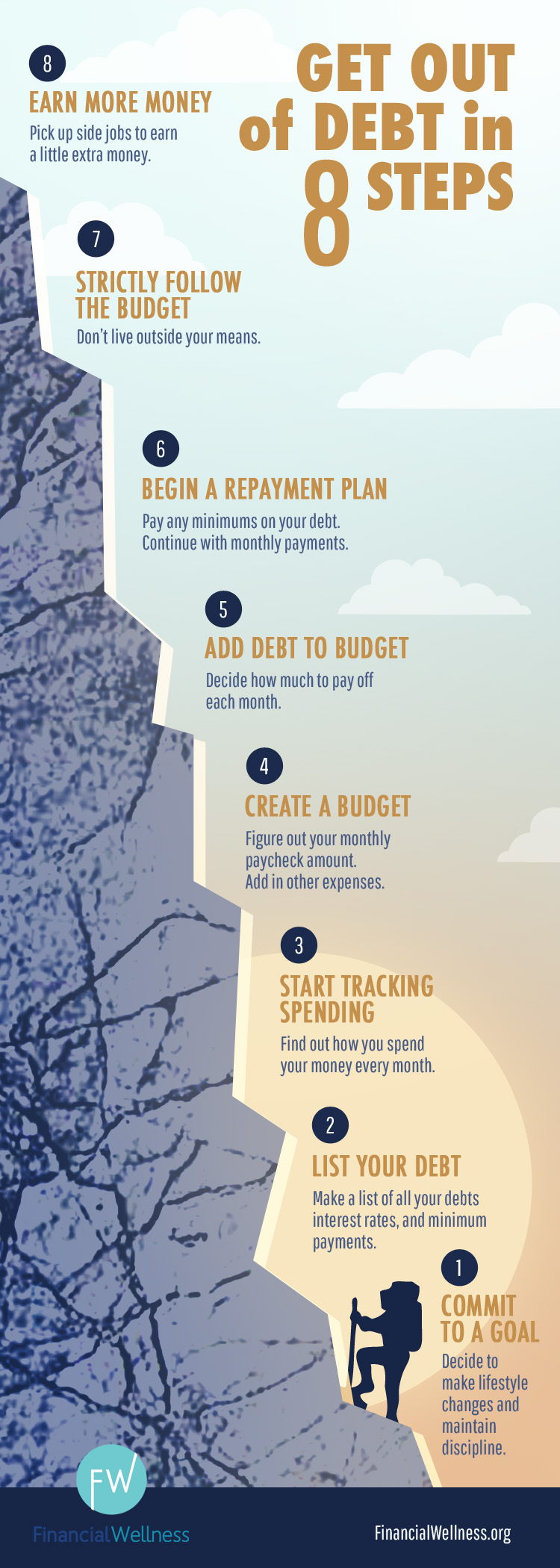

How to reduce or eliminate debt. The first step is to get a clear picture of your financial situation; Americor will find the best solution for you. Manage and reduce your spending.

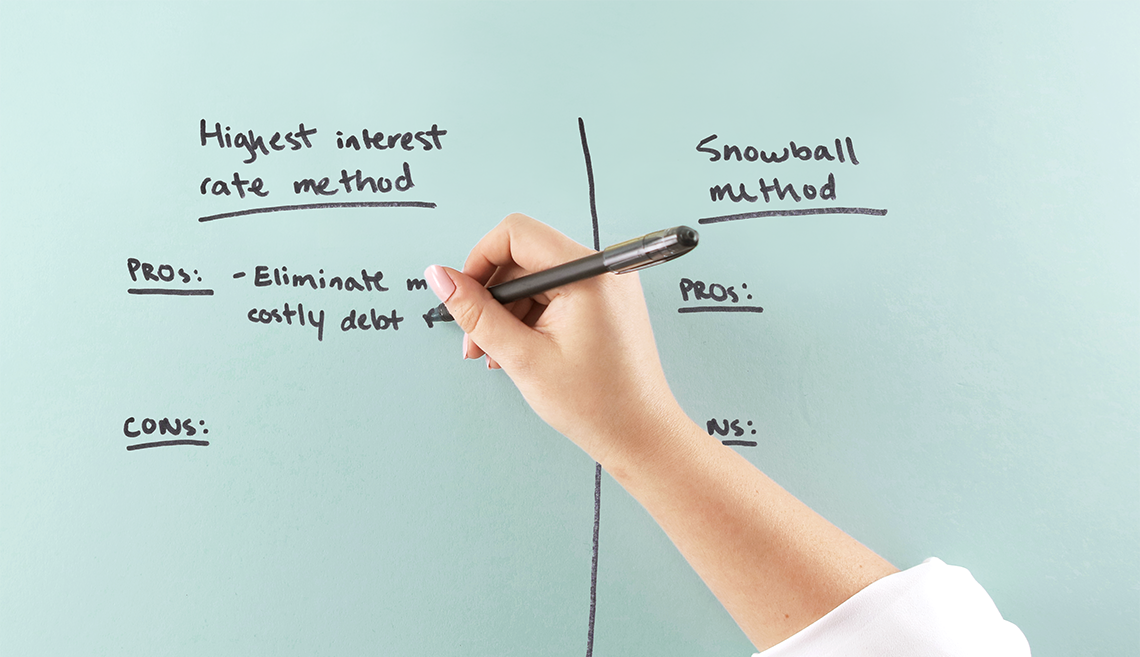

So, let’s explore simplified ways on how to eliminate debt quickly. 2 make a list of your current debts, including credit cards, student loans, medical debt and auto loans in order from the. The highest interest rate method and the snowball method.

Write down your monthly budget (using bank statements during this process will help. There are two basic strategies to reduce your debt: One way to do this is with the debt avalanche method:

The snowball and avalanche methods are two popular strategies for paying down debt:. Tackling your debt takes time and effort, but combining. You must be able to spend your money wisely if you want to learn how to eliminate debt once and for all.

Look through the pros and cons for each method and. Amidst mortgages, student loans, car loans, medical bills and credit cards, it is quite easy to fall into a. Paying off large chunks of your debt within a few months could save you a significant amount of money on interest payments alone.

Ad learn more about our debt resolution program today. Use savings to pay down larger debts don't be afraid to. Compare offers for your best rate and lowest monthly payment.

Whether your debt stems from a job loss, unexpected expenses, or overspending, it’s possible to reduce and eventually eliminate it. Find a lender & consolidate your debt today. Even when you are steady, paying those monthly bills can be such an arduous task.

Here are ten ways you can reduce your debt: Develop a budget to track your expenses a budget can help you monitor how much you’re earning and spending, and what you’re spending money. In his 1790 report, hamilton proposed a sinking fund to retire the public debt by issuing 6% bonds to replace older bonds issued by the states and the federal government.

Ad receive personalized loan offers in moments. Avoid bankruptcy and revive your credit! Getting into a debt trap is quite easy but getting out of it is not so much.

If you're going to aggressively reduce your debt, you're going to need to free up some additional money. Once you have your budget, it’s time to decide how to eliminate debt from your life.

/GettyImages-1093086154-058134c8013c4dba80e8fbd13289c7ab.jpg)

_1.jpg?ext=.jpg)