Awesome Info About How To Buy A Short Sell

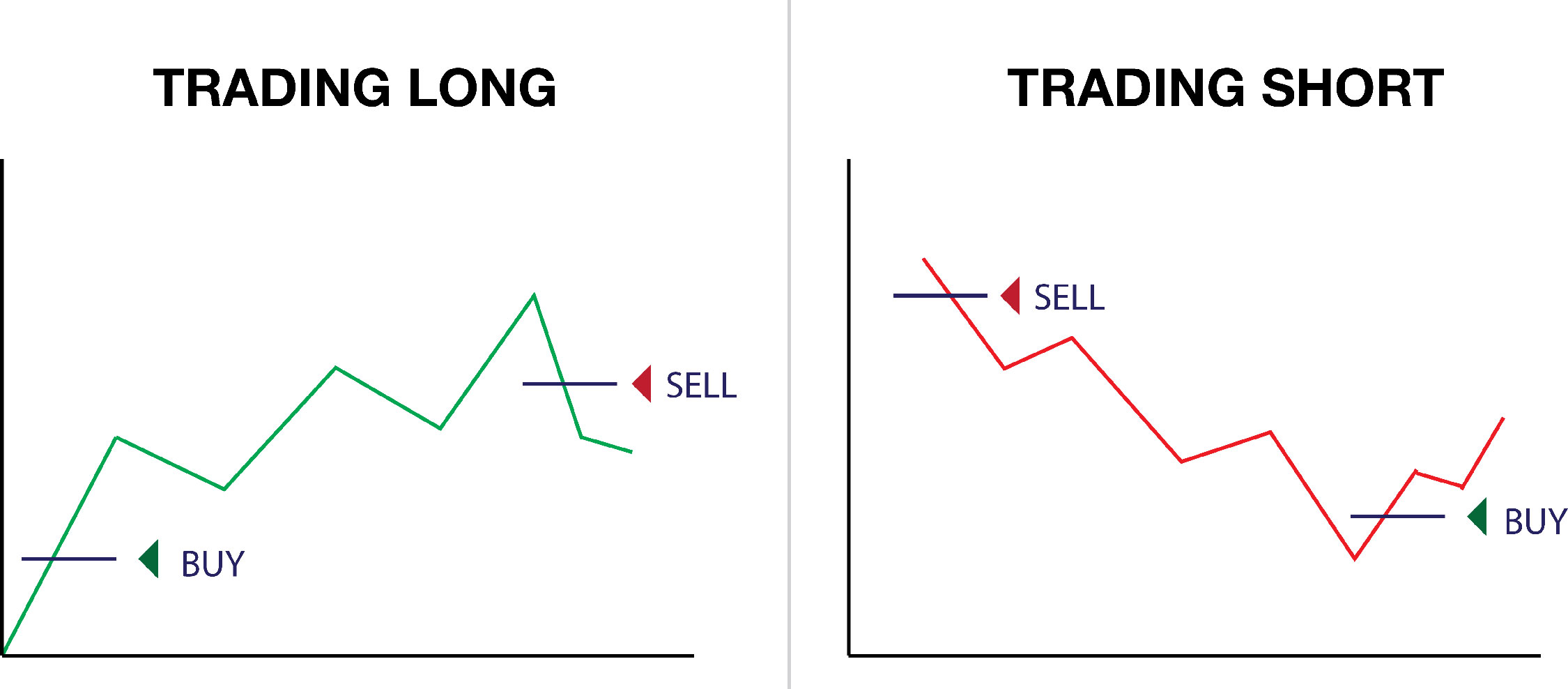

Most stock market investing is known as “going long”—or buying a stock.

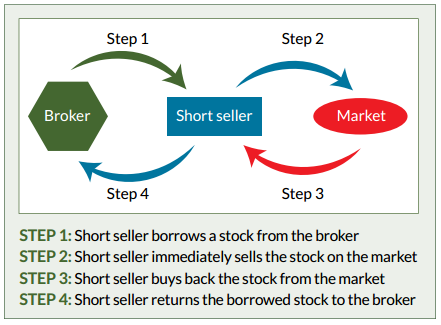

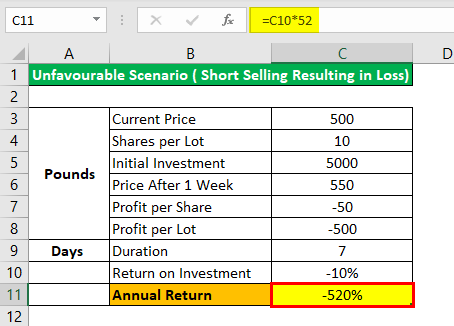

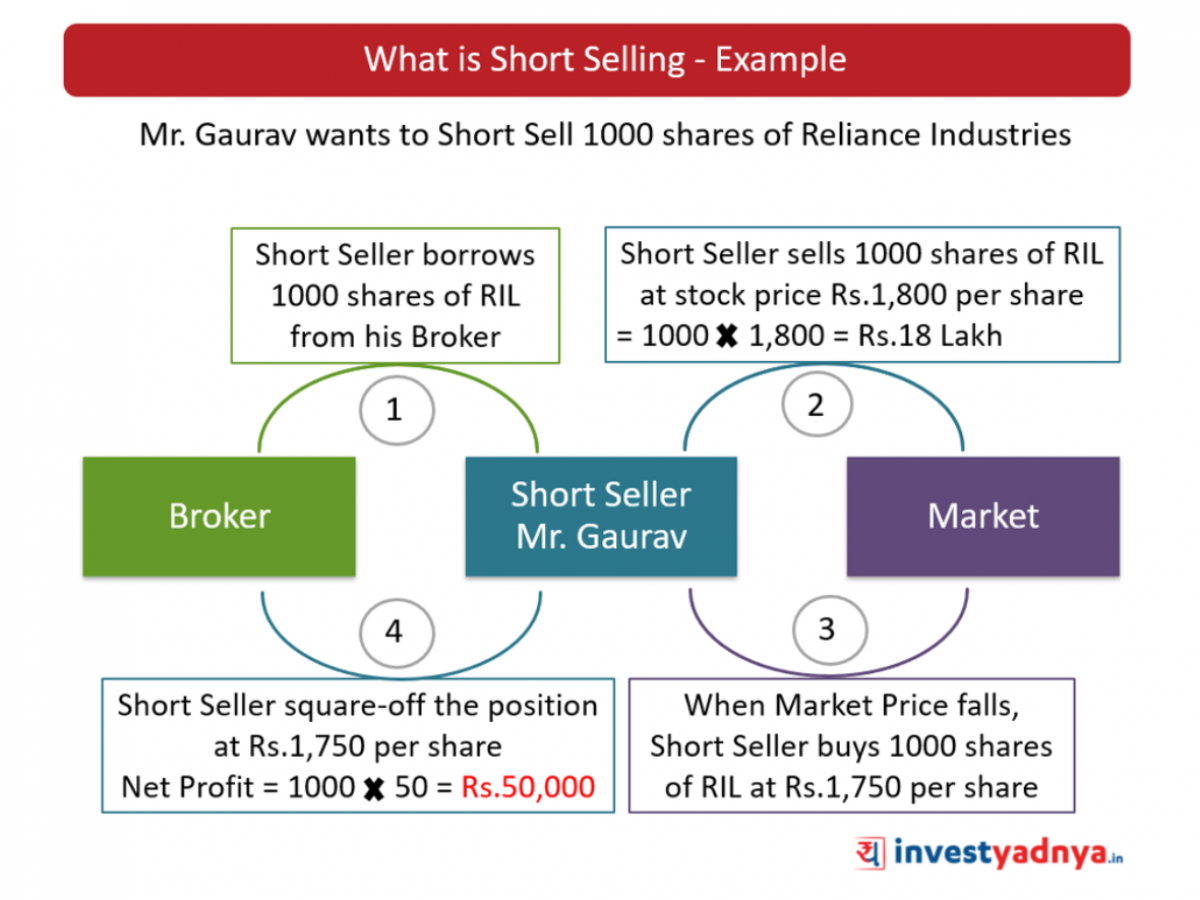

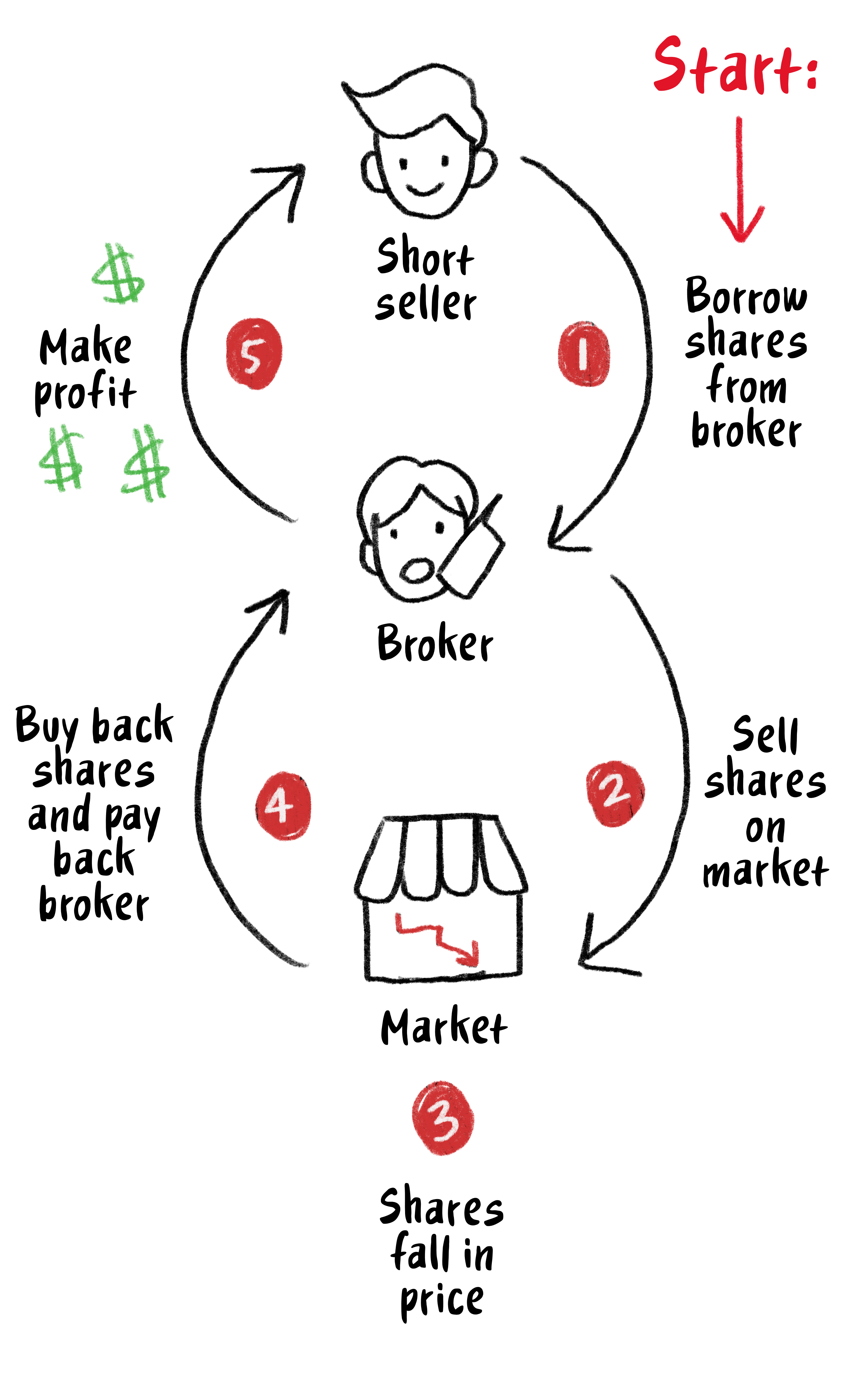

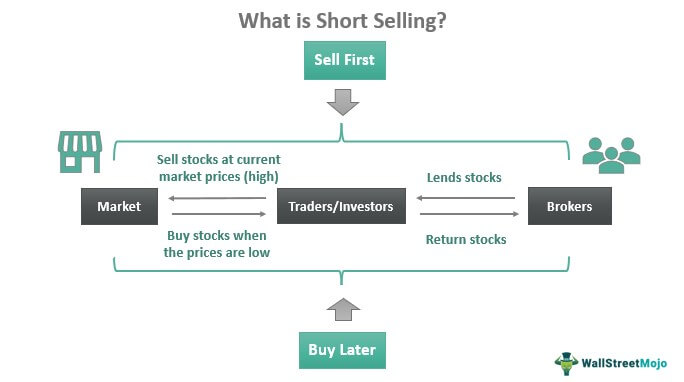

How to buy a short sell. The same distinctions can apply to selling versus short. The first thing needed to start short selling stocks is to check the margin requirements on the stock. To take a short position you borrow the shares from your broker and then sell them short.

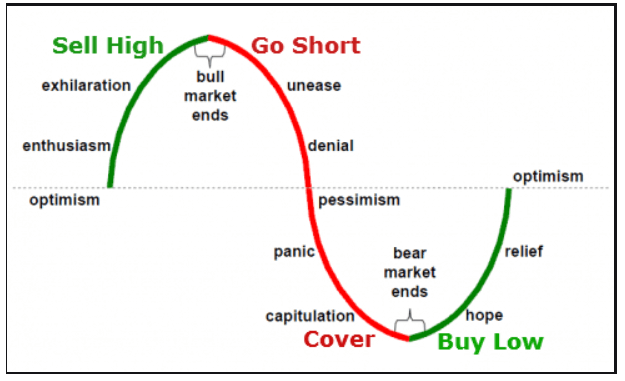

The increase in the security price causes short sellers to buy. Long not only conveys the action taken, but also current ownership, and therefore, it is much more descriptive than buy. It determines your profit, and the price of an asset at any given time.

Selling short, like going long, is an investment strategy. Buying and selling is trading at its most fundamental. You can still sell your ticket.

Stock ideas by experts for september 20, 2022 et now spoke to various experts and here's what they have to recommend for today's trading session. To close the trade you buy back the shares to return them to your brokerage firm. Although this means the lender will lose.

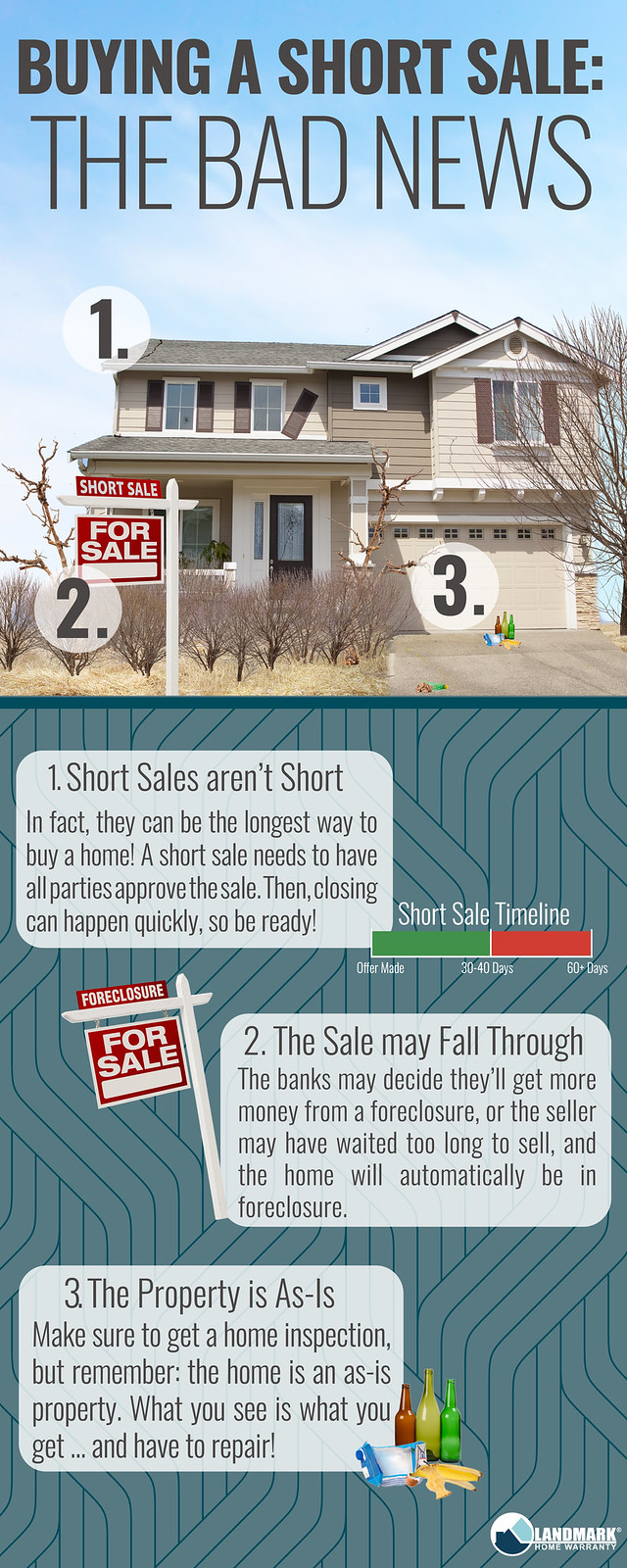

As we covered in the introduction to financial markets course, the. In order for a short sale to proceed, the lender must consent to the process and agree to accept less than the outstanding balance for the mortgage. Currently, you can place buy to cover and sell short orders on fidelity.com.

When shorting, the trader instructs their broker. You can purchase stocks at. A short squeeze involves a rush of buying activity among short sellers due to an increase in the price of a security.

When filling in this order, the trader has the option to set the market price. They were in the news not least because of the so. 14 hours agobuy or sell:

A trader can begin the options trade by either buying — “going long” — or selling — “going short.”. Pay attention to market trends. Discover events with your favourite artists.

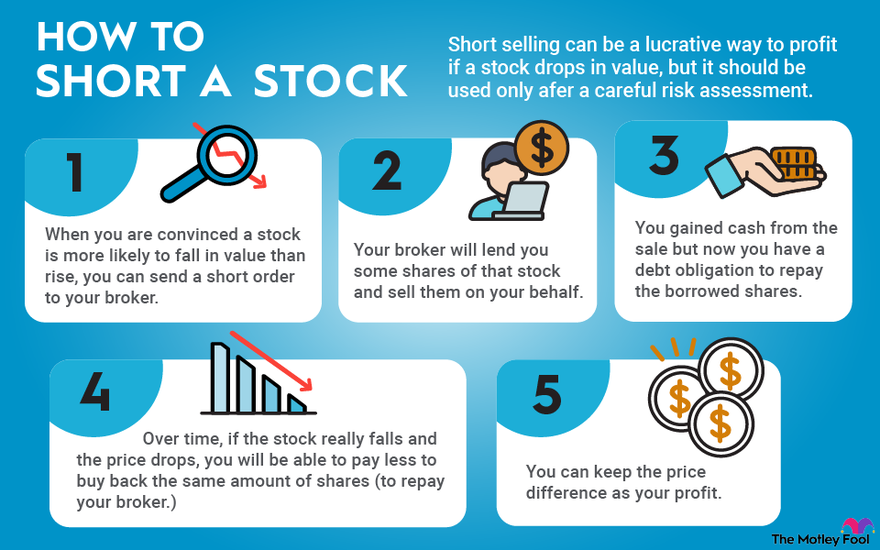

Here is the process of shorting stocks explained in five steps: October 19, 2021 by benjamin.