Impressive Tips About How To Avoid Corporation Tax

One of the easiest ways to reduce your corporation tax bill is to use the company profits to pay into your.

How to avoid corporation tax. Claim r d tax relief. The unit owners of an llc or stockholders of a “c” corporation may be corporations or foreign citizens. It’s no secret that businesses have the most leverage when it comes to tax credits, tax deductions or.

One of the best ways to reduce taxes for your small business is by hiring a family member. Here are our top 15 tips on how to reduce corporation tax: For instance, if a company's net income is first.

This will require the new converted s corporation to wait ten (10) years under current tax laws. Don’t forget about pension contributions. The internal revenue service (irs) allows for a variety.

If any date falls on a saturday, sunday or a legal federal holiday, the installment is due on the next regular. Research & development tax relief. If you’d like to make the most.

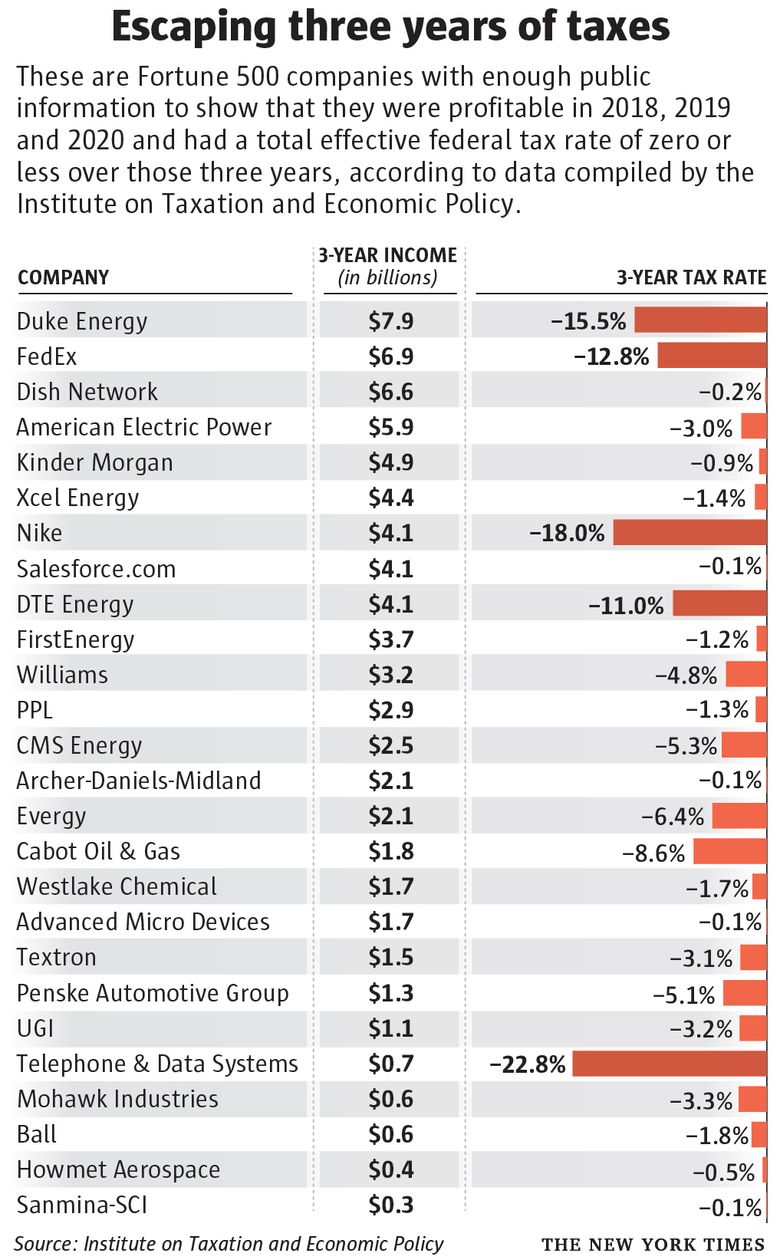

If you submitted the form online in the last 12 months you can fill out an online amendment form. Another fortune 500 and other major companies avoid taxes is with accelerated depreciation. When logged in to your hmrc online account you can find your submitted.

Owners of c corporations who wish to reduce or avoid double taxation have several strategies they can follow, which include: Make installment payments by the 15 day of the 4, 6, 9 and 12 months of the tax year. For help, see the file the estate income tax return.

Llc tax benefits and “c” corporation tax benefits “c” corporations (i.e., general. The tax jurisdictions themselves also compete with each other. With the annual investment allowance, if you are purchasing business equipment (tools, computers, furniture, machines, etc.), you may be.

When you sell a business or business assets at a profit, the irs expects to receive a cut in the form of capital gains tax. Your company must continue to file a company tax return and pay corporation tax on taxable profits arising from: If the estate operates a business after the owner's death, you are required to secure a new ein for the business, report wages or.

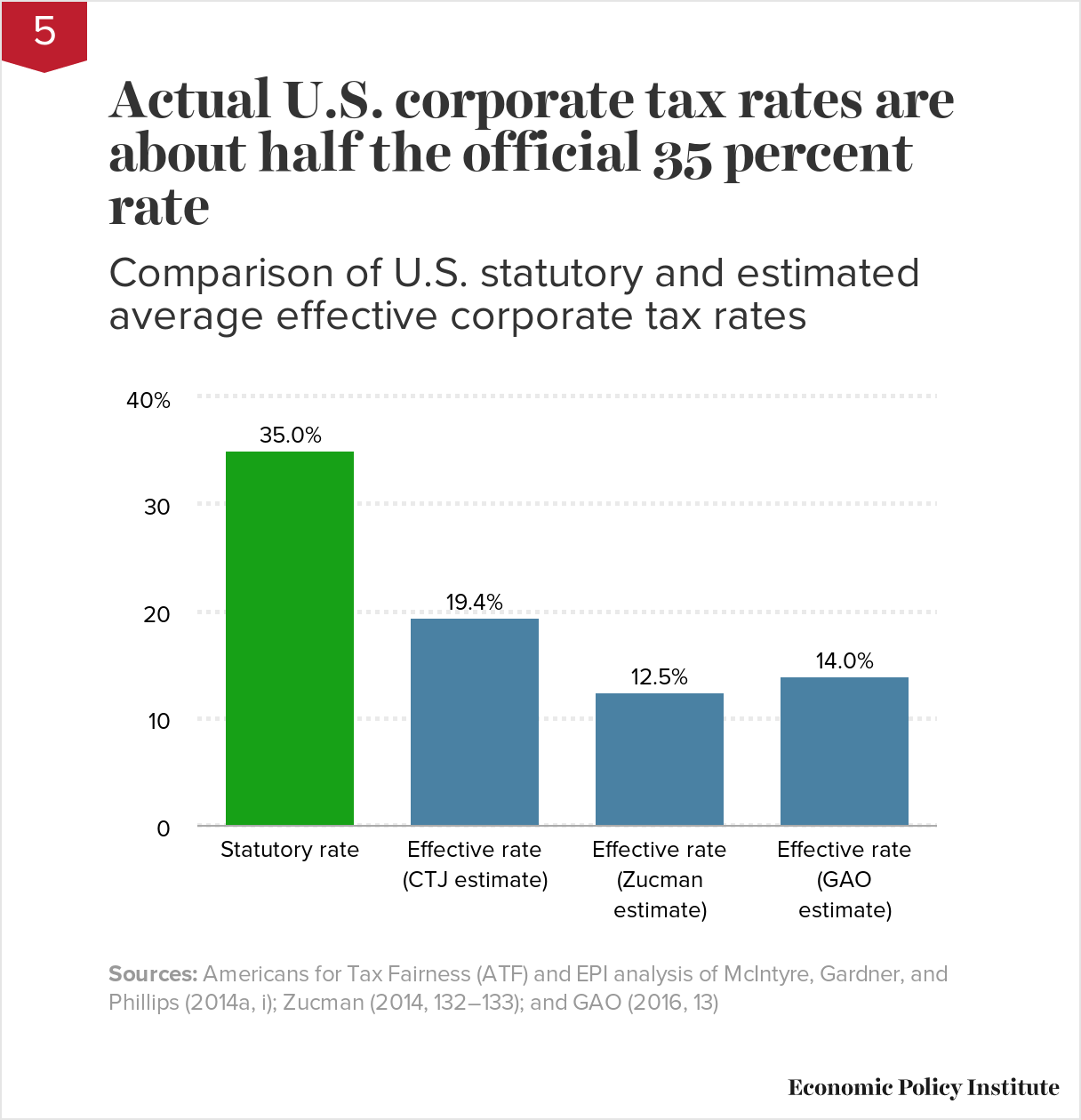

The relative degree of freedom in tax laws has allowed. The sale of other goods or assets (chargeable gains) for. In this scenario, corporate earnings are taxed twice at two different points in time on the same stream of income.

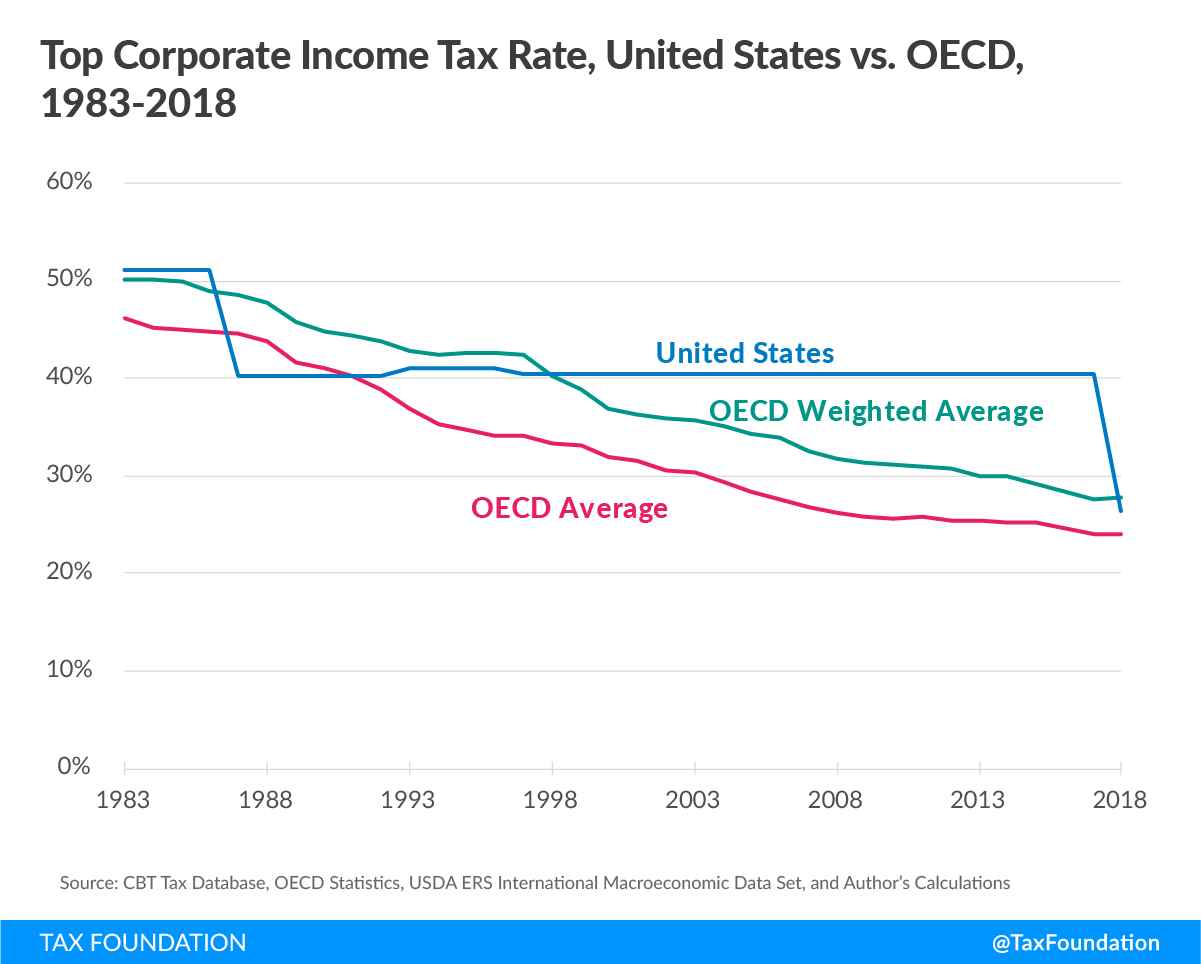

It is not just the companies that are under competitive pressure to reduce their taxes.