Fun Tips About How To Apply For Tin Philippines

Wait for the rdo to issue.

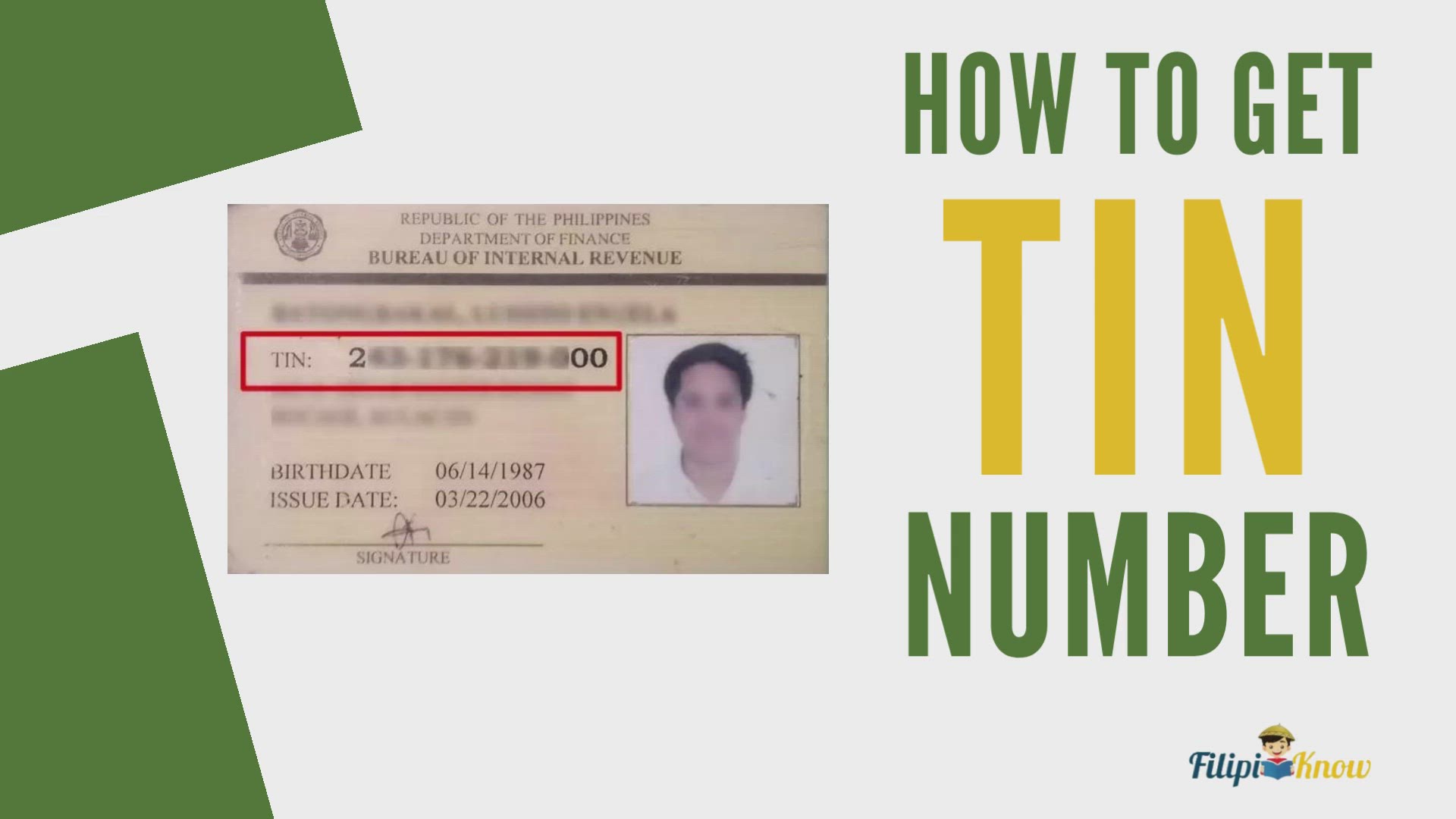

How to apply for tin philippines. On or before the commencement of business, or. Before payment of any tax. 98, any filipino above 18 years old including those who are unemployed can get a tin and a tin id that can be used for government transactions.

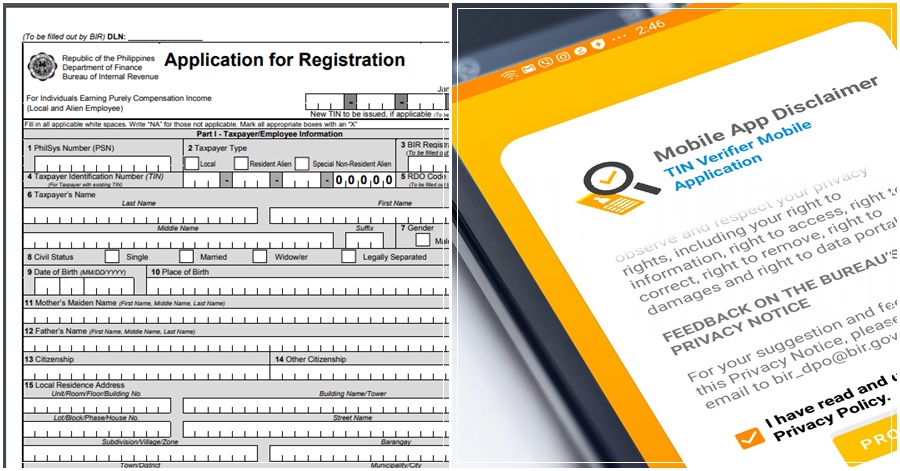

Ofws can apply for a tin in the philippines simply by visiting the nearest bir office and providing the following requirements: Photocopy of mayor’s business permit; The bureau of internal revenue (bir) has developed an e.

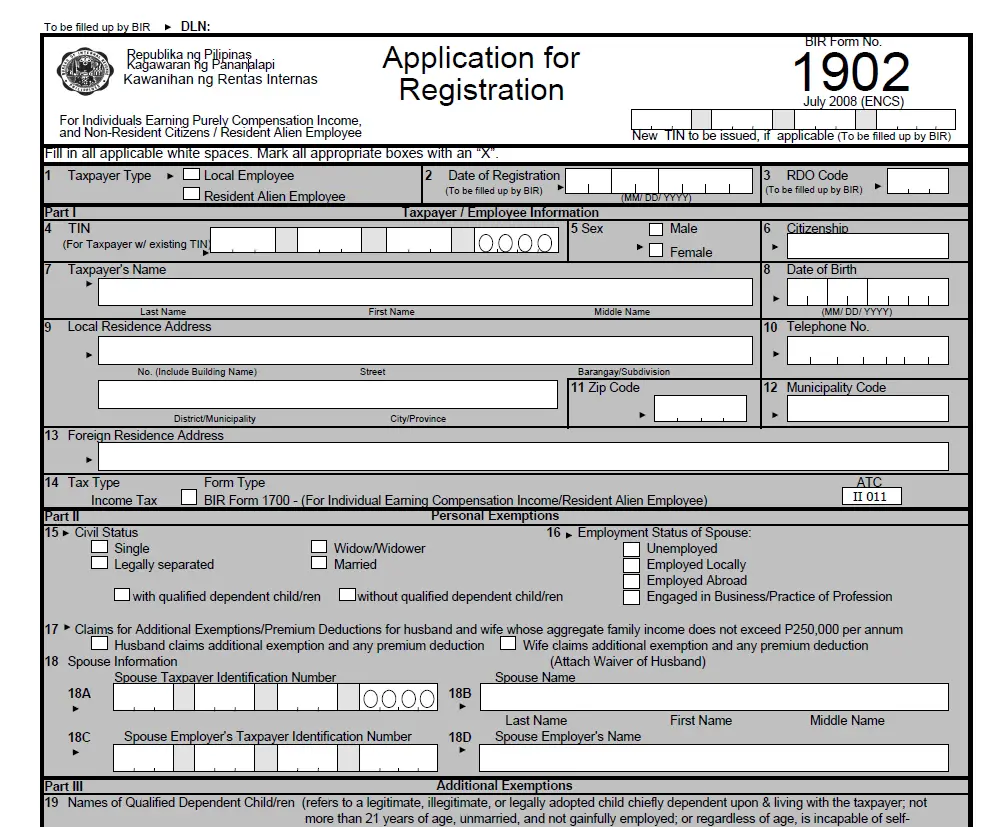

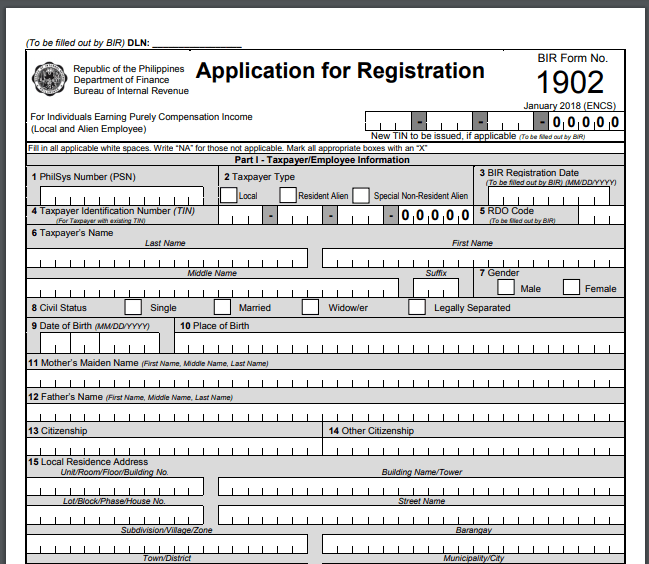

Fill out form tin application form (bir form 1904: Issuance of your tax identification number. Application for taxpayer identification number (tin) within ten (10) days from the date of employment, or.

Fill up the tin application form. Here is how you can apply for a tin as an unemployed individual in the philippines: Pay documentary stamp tax (dst) (loose dst / bir form 2000* for dst on contract of lease, etc).

98, you'll need to include copies of a valid id that show your name, address and your date of birth. Requirements, procedure, fees, and everything you need to know. Documentary requirements birth certificate or any valid.

How to apply for taxpayer identification number (tin) who needs to apply for tin? How to get a bir tin id in the philippines: Pay a visit to the revenue district office in charge of your present address or home.

Whether you are starting a business or applying for your first job, you need to. How to get taxpayer identification number (tin) online in 2022. If you are a new employee, it is your employer who will process your tin.

Or duly received application for mayor’s. Visit the bir ereg website. Fill up the online form.

If you're an individual applying for a tin using e.o. Visit the bir rdo where your tin was issued go to the bir. Pdf 2018 encs | pdf 2000 encs ) and submit it along with your proof of identities (valid ids).

If you already have a tax identification number (tin), simply visit the bir rdo to apply for a tin id card. Any person, whether natural or juridical, required under the authority of the internal revenue code to make,. Online application is not allowed for now on their website.mus.